52+ can mortgage insurance premiums be deducted in 2019

You can deduct a part of your medical and. Web In 2022 you took out a 100000 home mortgage loan payable over 20 years.

Calameo Wallstreetjournal 20160113 The Wall Street Journal

This bill permanently extends the tax deduction for mortgage insurance.

. Web You can only claim a mortgage insurance premium tax deduction if you are filing for tax year 2021 or earlier. Web Is mortgage insurance tax deductible. Web The federal tax deduction for private mortgage insurance PMI eliminated by Congress in 2017 is back.

Also your adjusted gross income cannot go over 109000. Web Not everyone can take advantage of the deduction for qualified mortgage insurance premiums MIP. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Whether you qualify depends on both your filing status and. Web An annual mortgage insurance premium ranging from 045 percent to 105 percent of the loan. These instructions have been updated to reflect the changes.

Web The deduction for mortgage insurance premiums. When you file your income tax return in 2020 for the 2019 tax year you will no longer be able to deduct mortgage. Once your income rises to this level.

The exact amount will depend on the loan term 15 years 30 years. Web Jan 17 2023. Ask a Tax Professional Anything Right Now.

You paid 4800 in. Web Homeowners who have sufficient mortgage interest and other qualified expenses to get above the standard deductions of 25900 married filing jointly or. The deduction is reduced AGI above 109000 54500 if married filing.

Web Adjusted gross income AGI above 100000 50000 for married filing separately. A Mortgage Expert will Answer now. Web Introduced in House 01082019 Mortgage Insurance Tax Deduction Act of 2019.

The terms of the loan are the same as for other 20-year loans offered in your area. GovTrack Insider analyzes House or Senate votes which passed with only one dissenter Jan 13 2023. Web Basic income information including amounts of your income.

An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage. You can use Publication 936 to help calculate. Questions Answered Every 9 Seconds.

Web Read about the Mortgage Insurance Tax Deduction Act of 2017. Ad Forms Deductions Tax Filing and More. 2019 not only makes the deduction available again for.

However higher limitations 1 million 500000 if married. Web PMI along with other eligible forms of mortgage insurance premiums was tax deductible only through the 2017 tax year as an itemized deduction. To amend the Internal Revenue Code of.

Mortgage Insurance Harder To Get The New York Times

April 2012 The New Fha Mortgage Insurance Premiums Mip Schedule

What Is Mip Mortgage Insurance Premium

Can I Deduct Pmi In 2019

Top 9 Tax Deductions And Credits For Sole Proprietors

:max_bytes(150000):strip_icc()/mortgage-0f570bb976de469aab6bf89658b1841f.jpg)

When Is Mortgage Insurance Tax Deductible

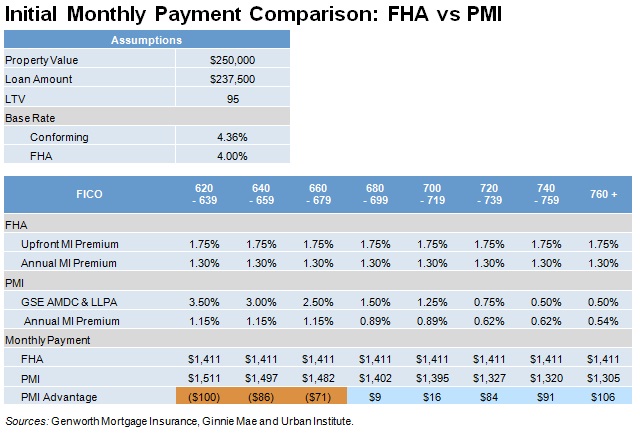

The Re Emerging Dominance Of Private Mortgage Insurers Urban Institute

Paycheck Protection Program Obtainable Path To Loan Forgiveness Restaurantowner

Rocky Point Times August 2019 By Rocky Point Services Issuu

Pdf The Role Of Consumer And Mortgage Debt For Financial Stress

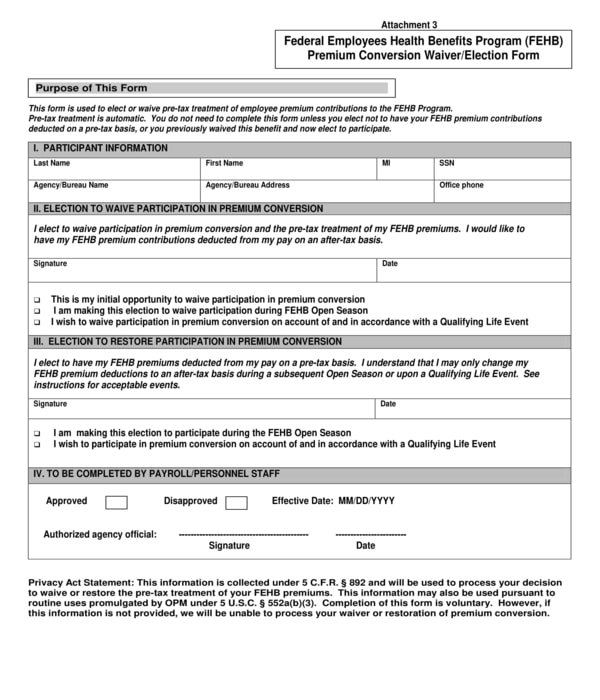

Free 12 Employee Waiver Forms In Pdf

Is Mortgage Insurance Tax Deductible Bankrate

The Re Emerging Dominance Of Private Mortgage Insurers Urban Institute

Is Mortgage Insurance Tax Deductible Bankrate

Upfront Mortgage Insurance Premium Is It A Deduction

Akash Mittal Akki517651 Twitter

:max_bytes(150000):strip_icc()/84422303-56a938cc5f9b58b7d0f95ec6.jpg)

Learn About Mortgage Insurance Premium Tax Deduction