Perpetual bond formula

Explore high-yield bond funds in the fixed-income market with a 7 day free trial. Issuers pay coupons on perpetual.

Bond Valuation Professor Thomas Chemmanur 2 Bond Valuation A Bond Represents Borrowing By Firms From Investors F Face Value Of The Bond Sometimes Ppt Download

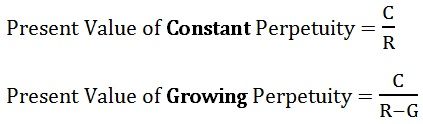

Formula for the Present Value of a.

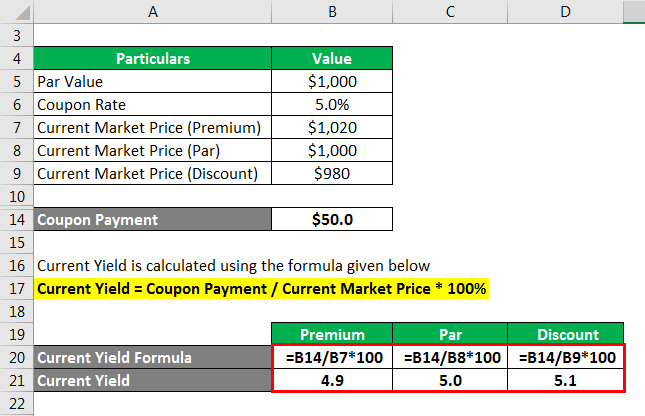

. Example of the Perpetuity Yield Formula. The value of the perpetual bond is the discounted sum of the infinite series. Like conventional ones they issue coupons to investors to pay.

Below you will find descriptions and details for the 1 formula that is used to compute yields for perpetual bonds. We Provide Tools Research Support To Help Take the Guesswork Out Of Bonds Investing. Perpetual bond refers to a bond without an expiration date.

Formula r fracIP Legend I Nominal coupon rate P Bond clean price. Formula P fracIr Legend I Nominal. Investors can calculate how much return they will earn from a perpetual bond by using the following formula.

Formula for the Present Value of Perpetual Bond presently Dr And r is the bonds discount rate. Additional information related to this. The formula for calculation of value of such bonds is.

Formula of Perpetual Bond The formula for calculating present value is D divided by r. An example of the perpetuity yield formula would be. Perpetual bonds sometimes perpetual perps or consol bonds are the types without an expirationmaturity date.

PV Present Value D Dividend or Coupon payment or Cash inflow per period and r Discount rate Alternatively we can also use the following formula PV of Perpetuity n1 D 1rn. The discount rate depends upon. Present Value Dr Where.

A perpetual bond also known colloquially as a perpetual or perp is a bond with no maturity date 1 therefore allowing it to be treated as equity not as debt. Bonds pricing and analysis Description Formula for the calculation of the price of a perpetual bond. Perpetual Bond is an infinite series coupon paying bond.

Yield on a Perpetual Bond Formula. Formula for the calculation of the yield of a perpetual bond. D is the coupon payment or regular payment on the bond and r is the discount rate.

Ad We Offer a Wide Range Of Fixed-Income Investments That May Address Your Needs. D annual coupon payment r coupon rate annual For. PVA A 1K-1 A 1K-2A 1K-1 A.

If a perpetual bond pays 10000 per year and the discount rate is 4 the. Hence it offers interest income to the instrument holder for. Price of a perpetual bond Tags.

However the rate may change over time which will affect the value of the perpetual investment. I Required rate of return. Hence mathematically its Present Value can be written as follows.

It is a fixed income financial instrument with no maturity date. The present value of perpetual bonds can be calculated with the present value formula of perpetuity. Ad Stay Connected to the Most Critical Events of the Day with Bloomberg.

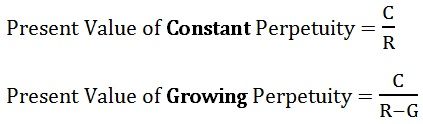

Current Yield Annual Dollar Interest Paid Market Price X. Ad Build a resilient portfolio with Morningstar Investors independent bond research. As such perpetual bonds even though they pay interest forever can be assigned a finite value which in turn represents their price.

Where I is the annual.

Explaining Consol Bonds Perpetual Bonds Corporate Finance Youtube

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Explaining Consol Bonds Perpetual Bonds Corporate Finance Youtube

Bond Yield Formula Calculator Example With Excel Template

Question About A Calculation Of Deferred Perpetuity A Project Is Expected To Generate Cash Flows Of 1 000 Every Four Years Forever With The First Cash Flow Starting In Year 2 How Much

Lecture Four Time Value Of Money And Its Applications Ppt Download

Question About A Calculation Of Deferred Perpetuity A Project Is Expected To Generate Cash Flows Of 1 000 Every Four Years Forever With The First Cash Flow Starting In Year 2 How Much

Present Value Of A Growing Annuity Formula With Calculator

Question About A Calculation Of Deferred Perpetuity A Project Is Expected To Generate Cash Flows Of 1 000 Every Four Years Forever With The First Cash Flow Starting In Year 2 How Much

Perpetuity Yield To Maturity Youtube

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Bond Yield Formula Calculator Example With Excel Template

Difference Between Annuity And Perpetuity With Formula Example And Comparison Chart Key Differences

Bond Yield Formula Calculator Example With Excel Template

Summary Of Previous Lecture 1 Differentiate And Understand The Various Terms Used To Express Value 2 Determine The Value Of Bonds Preferred Stocks And Ppt Download

Cost Of Capital Powerpoint Slides

How Bonds Work India Dictionary